Exclusive data and figures: What the end of lockdown meant for online sales

iAdvize

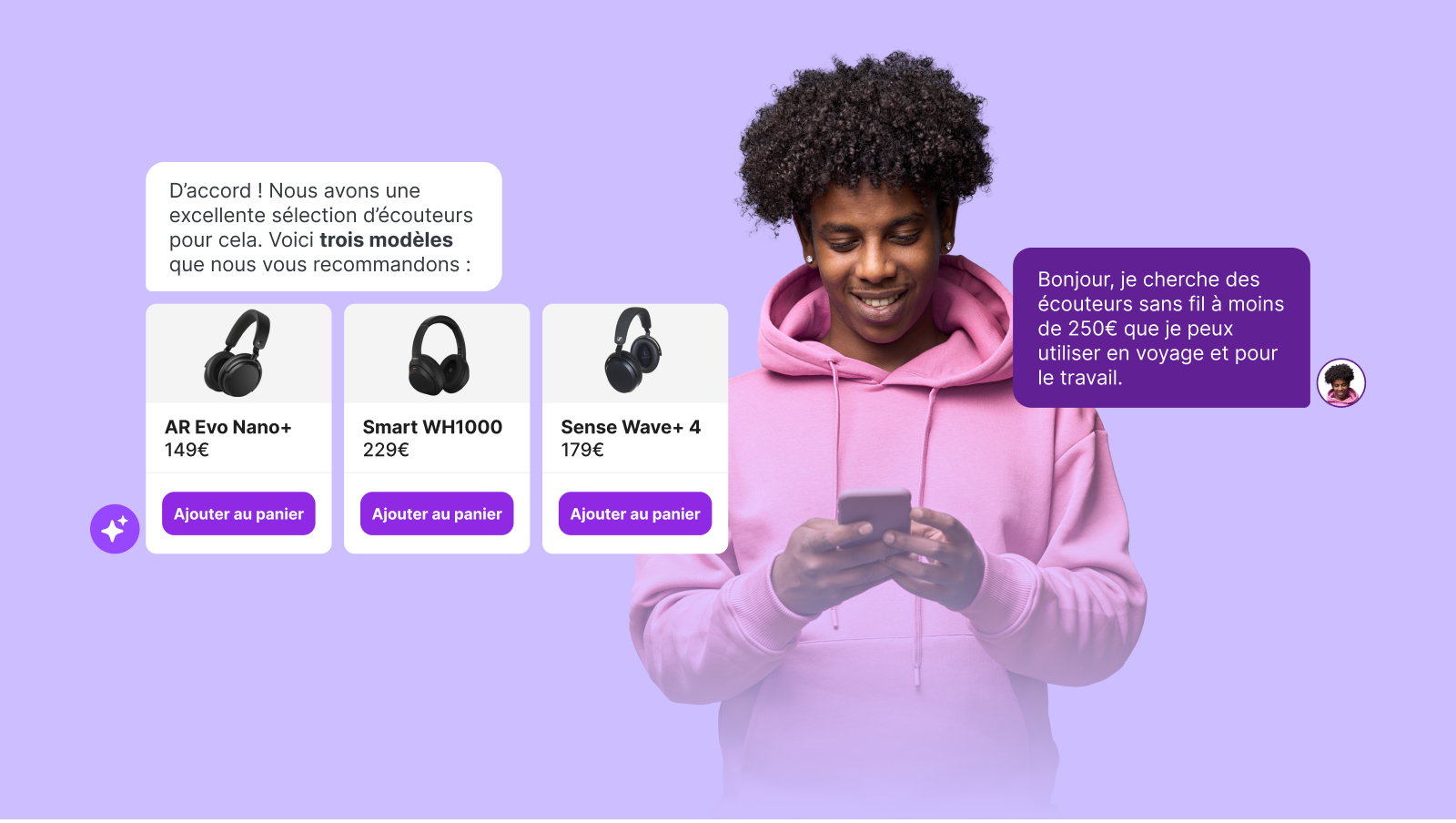

From the onset of the COVID-19 pandemic, more than 35 million transactions and more than 54 million messages have been exchanged on our conversational platform between consumers and more than 2,000 brands. Analyzing this data allowed us to create a Trend Watch, to better inform a company’s decision-makers. When stores began to reopen, how have online sales been affected? We provide the answer to this question here.

COVID-19 has undoubtedly left lasting effects, one of them is the acceleration of digital use. Commercial activity shifted online at breakneck speed in many countries around the world as governments declared lockdowns. When posed the question if e-commerce would continue to perform at an all-time high once the crisis is over, The answer for McKinsey was, in part, yes. "We expect changes in consumer preferences and business models to outlast the immediate crisis. This has begun to play out in China, where there has been a 55 percent increase in consumers intending to permanently shift to online grocery shopping, and an increase of three to six percentage points in overall e-commerce penetration in the aftermath of COVID-19."* Since the beginning of the month and especially on May 11th, 2020, measures to end the lockdown were gradually increasing in Europe and around the world. This was an opportunity to observe the evolution of digital activity, and to get a first glimpse of post-crisis trends.

1. Traffic and transactions: e-Commerce continued its upward trajectory while tourism remained off the table

The progression of coronavirus has created a response in online commercial activity globally, resulting in an explosion of traffic and online sales for multiple players in the consumer goods sector. In Italy, e-commerce sales for consumer products rose by 81% in a single week, at the beginning of March 2020.* Thus, as the end to social distancing began in numerous regions around the world, the question was then, how will e-commerce evolve?

The new online habits introduced from the lockdown have come to stay as part of our daily lives; at least, that’s what the research from GlobalWebIndex shows. It reveals that nearly half of the world's consumers did not plan to return to physical stores "for a while" or "for a long time" once the rules of isolation had been relaxed. In fact, only 9% of shoppers say they were ready to revisit shops "immediately" after the measures were lifted.**

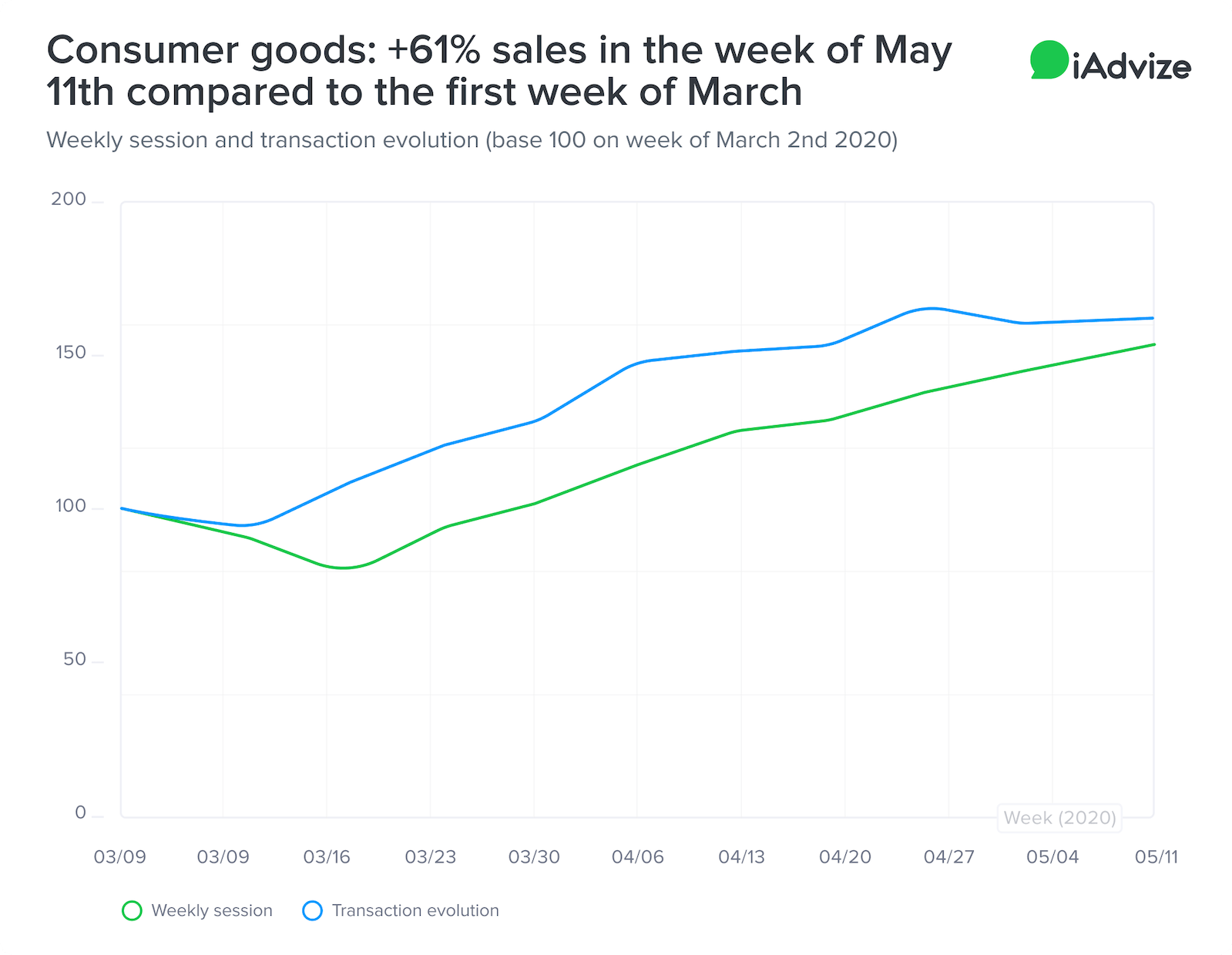

It comes as no surprise that the data collected from our platform, represented in the graph below, confirms the clear preservation of digital activity in the first weeks of May 2020. Since the week of May 11th, which marks the first week of the end of the lockdown in France, traffic continued to grow on the sites of our clients in the consumer goods sector (+53% visits compared to the first week of March). We also recorded a 61% increase in online sales during the week of May 11th compared to the first week of March, after a peak of +65% at the end of April.

Among the verticals that seemed to be benefiting from the lockdown, let us note the breakthrough of the fashion & jewelry sector, which achieved +31% of sales in the week of May 11th compared to the previous week, and that of household appliances, with +6% of transactions.

Consumer Goods sales increase from May - March 2020

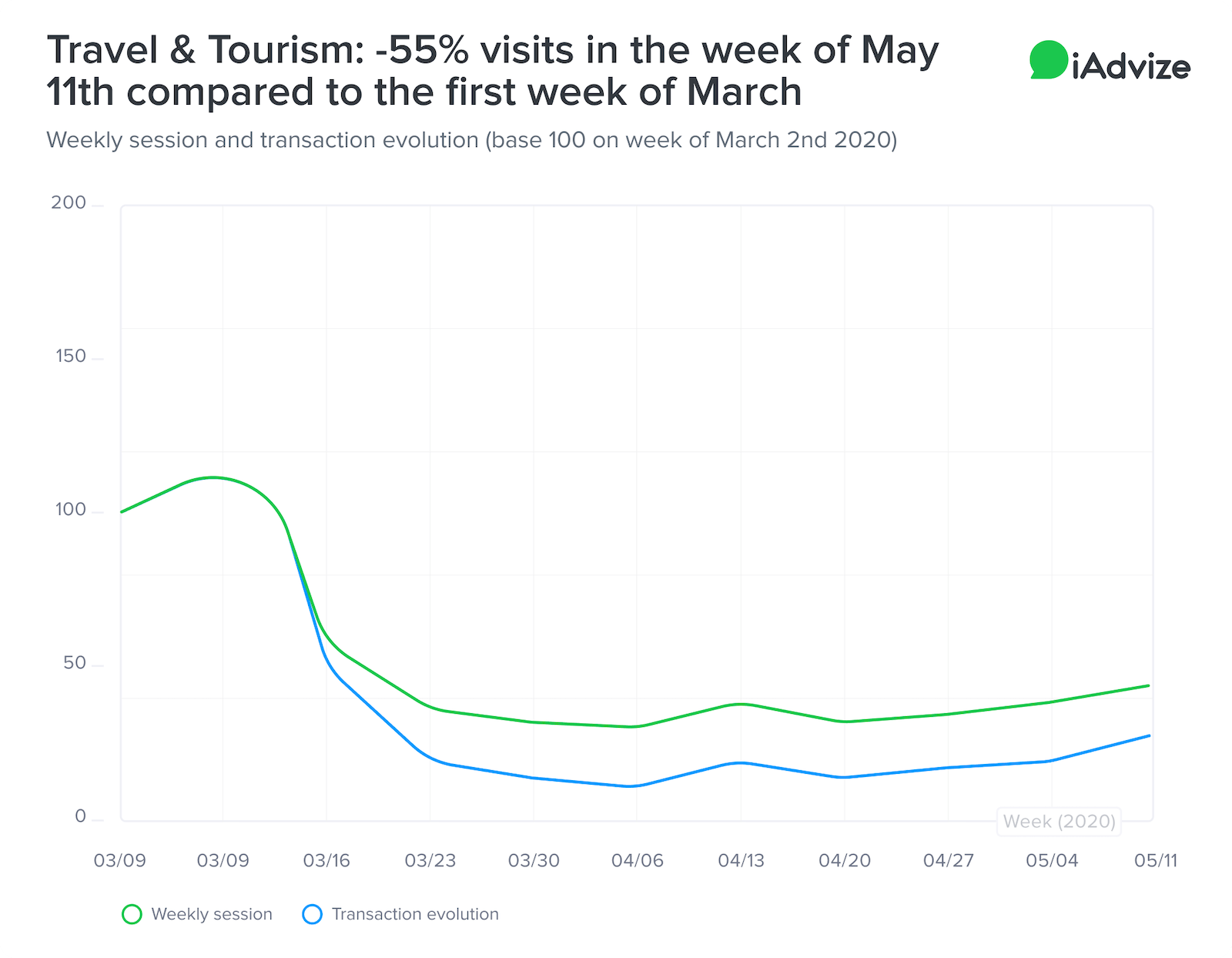

Let’s turn to the tourism and transportation sector. The measures put in place during the lockdown, travel bans and border closures hit tourism activities hard, threatening the market to close a third of its global turnover in 2020, according to UNWTO.

The graphs below show the evolution of traffic and online sales for our customers in the transport, tourism and travel industry. The week of May 11th, traffic on industry sites was up slightly but was still half of what it was in the first week of March, 2020. Transactions experienced the same trend, going as low as -71%.

Travel & Tourism website visits decrease from May - March 2020

2. Online conversation volumes gradually return to normal

Purchasing advice, requests related to delivery times, cancellation, or the postponement of orders, etc. the need for online support and reassurance had never been more important than during the crisis. From the beginning of March, we observed very high volumes of conversations on our platform.

- In the consumer products industry, conversation volumes steadily increased from the beginning of the crisis, even doubling by the end of April. The week of May 11th, we saw the beginning of a slowdown, with a 9% drop in conversations compared to the previous week. However, volumes remained well above pre-crisis averages, with still +84% more conversations compared to the first week of March. These high volumes were linked to the strong e-commerce activity in this sector.

- In the transport, tourism and travel industry, concerns related to the health crisis began at the end of February. Unsurprisingly, conversation volumes, were therefore half as large as was recorded at the beginning of March 2020. Online conversations resumed during the week of May 11th (+23% compared to the previous week), in correlation with the uptick in traffic.

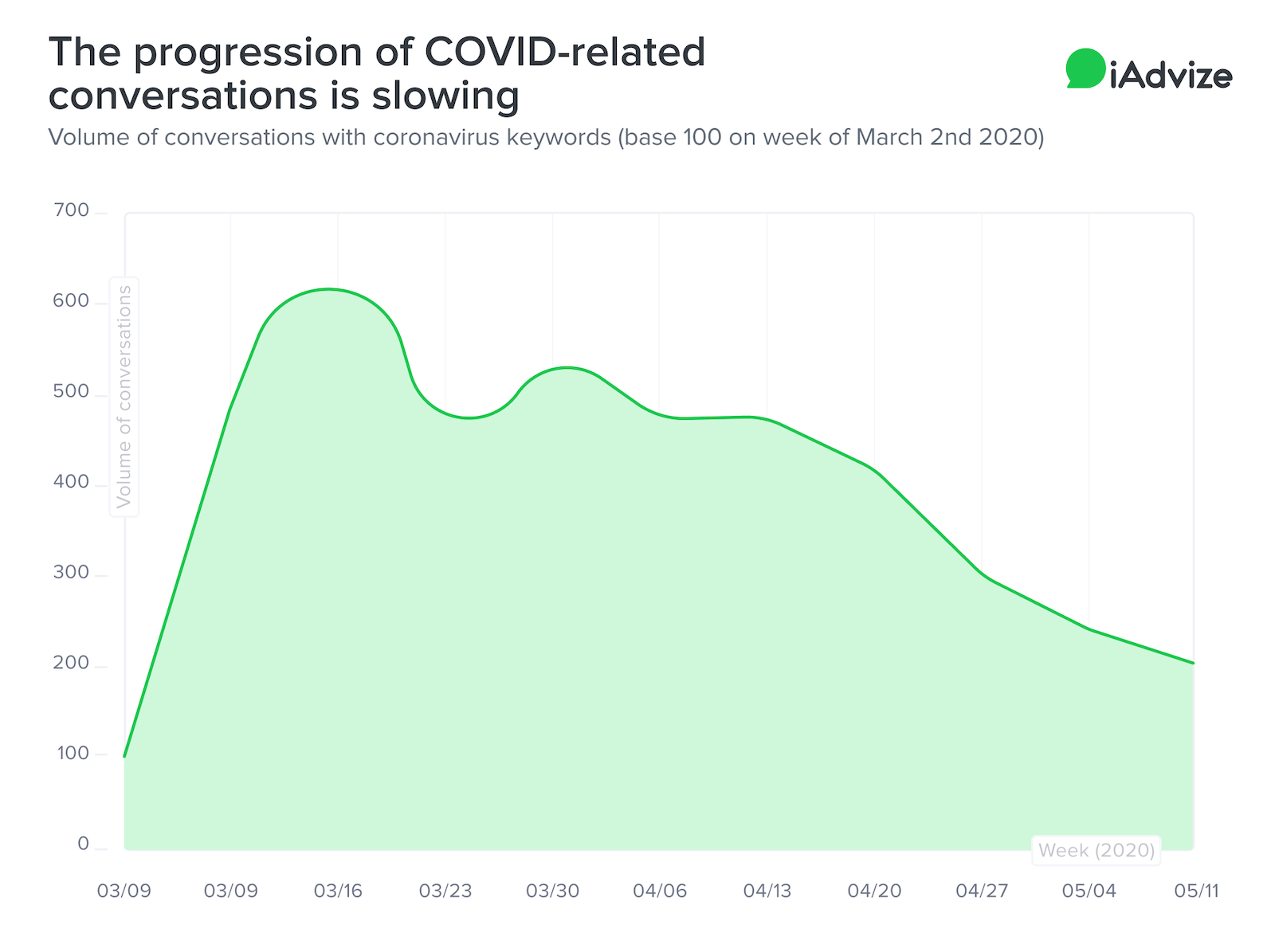

3. Customer insights: visitors begin asking less COVID-related questions

Which subjects are visitors asking brands? Our platform allows us to collect and analyze the content of online exchanges, in order to track customer concerns in real-time. As shown in the graph below, since the beginning of March, conversations mentioning terms related to COVID-19 have continued to grow across all sectors, seeing a peak in the week of March 16th. However, the trend is slowing drastically. During the week of May 11th, conversations related to coronavirus showed twice as high as in early March, compared to 6 times in the week of March 16th; the beginning of lockdown.

Progression slows in covid-related conversations

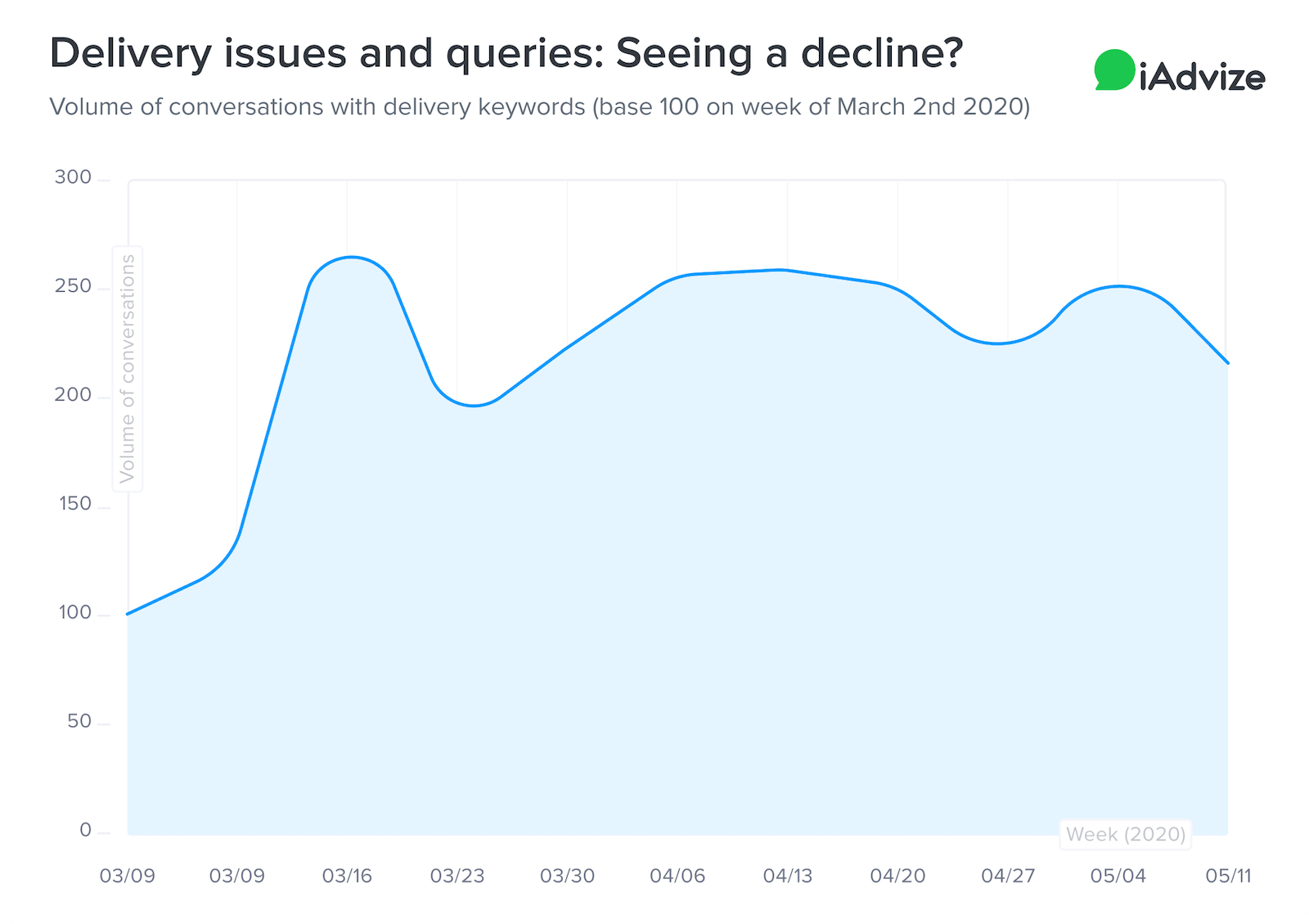

The end of the lockdown along with strict health measures was presumed to lead to a return to normal delivery times and conditions for orders. The graph below represents the evolution of conversations dealing with delivery or cancellation of orders on our platform since the beginning of March 2020. These have more than doubled since March 16th. The volume of conversations about delivery or cancellation of orders remained twice as high in the week of May 11th.

Delivery issues queries decline

Sources : *McKinsey & Company, Adapting customer experience in the time of coronavirus, 2020

**GWI, Coronavirus Research, April 2020 Multi-market research wave 3

.png)

.png)